Sophia’s Thoughts On Altcoin Resurgence

Altcoins are stirring back to life—and for the first time in months, momentum isn’t just with Bitcoin.

These are Sophia's Thoughts:

Capital is rotating out of Bitcoin and into Ethereum, Solana, and other majors, as altcoin sentiment begins to shift with on-chain, price, and dominance data all pointing to early-stage rotation.

Institutional inflows, regulatory clarity from the GENIUS Act, and booming ETF demand are fueling renewed interest in Layer-1s like ETH and SOL.

While flows are growing, most altcoins remain on the sidelines; the rally is real but currently limited to a few assets with strong narratives and institutional access.

🚀 Last week’s market performance

The crypto market rose 4.4% this week, despite Bitcoin (BTC) slipping 2.0% as it pulled back from recent highs. Conflux (CFX) led the gains, surging 115.9% following the announcement of its Conflux 3.0 upgrade. On the downside, 1inch Network (1INCH) was the weakest performer, dropping 10.1%.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

🌊 A New Wave in Crypto Markets

The crypto market is stirring. Bitcoin remains the bedrock of digital assets, supported by institutional conviction and steady on-chain accumulation. But as it consolidates near record highs, capital is beginning to rotate into higher-beta altcoins. Ethereum, Solana, XRP, and others are gaining momentum, signaling the early stages of what could be a new altcoin season.

Bitcoin dominance has slipped around 10% from a high of 66% in late June to 60% today, reflecting a subtle but significant structural shift. The Altcoin Season Index has crossed 50 for the first time since December, and the TOTAL2 market cap (which excludes Bitcoin) has climbed to USD 1.5 trillion, nearing its yearly peak. These signals point to rising appetite for risk and diversification across the crypto landscape.

Structural tailwinds, regulatory clarity, institutional accumulation, and deepening liquidity are all fueling the shift. With Bitcoin hovering at all time highs between USD 116,000 to USD 120,000, the window for altcoins to outperform is wide open. If capital flows continue and macro conditions remain stable, this rotation could mark the start of a significant new phase in the cycle.

🔑 Catalysts Powering the Rotation

The move into altcoins is being driven by an array of developments. The GENIUS Act, passed in July, has established a regulatory framework for stablecoin issuance in the U.S., giving both banks and fintechs a path to participate. This legislation strengthens the investment case for Layer-1 blockchains like Ethereum, Solana, and XRP, networks that serve as the foundation for tokenized financial infrastructure.

Institutions are also accumulating at unprecedented paces. SharpLink Gaming, now recognized as a leading Ethereum treasury firm, brought its total ETH holdings to over 360,000 ETH, valued at USD 1.3 billion. Last week alone, the company acquired nearly 80,000 ETH, marking one of the largest single-week purchases by a corporate treasury in crypto history. The Ether Machine and others have followed similar paths, reinforcing Ethereum’s emerging status as a digital reserve asset.

Meanwhile, institutional flows into Ethereum ETFs hit an all-time record of USD 2.12 billion last week. This was nearly double the previous high. Ethereum’s year-to-date inflows now stand at USD 6.2 billion, already surpassing its full-year total for 2024. Momentum is building around Solana as well. The newly launched Spot SOL ETF from SSK has already surpassed USD 100 million in AUM after just 12 trading days, highlighting growing institutional demand for altcoin exposure beyond Ethereum.

Retail is returning too. Google search interest for “altcoin” has reached its highest level since November 2024, a leading indicator of retail attention. Sell pressure appears to be easing, freeing up room for altcoin markets to run.

⚠️ Still Early, Still Risky

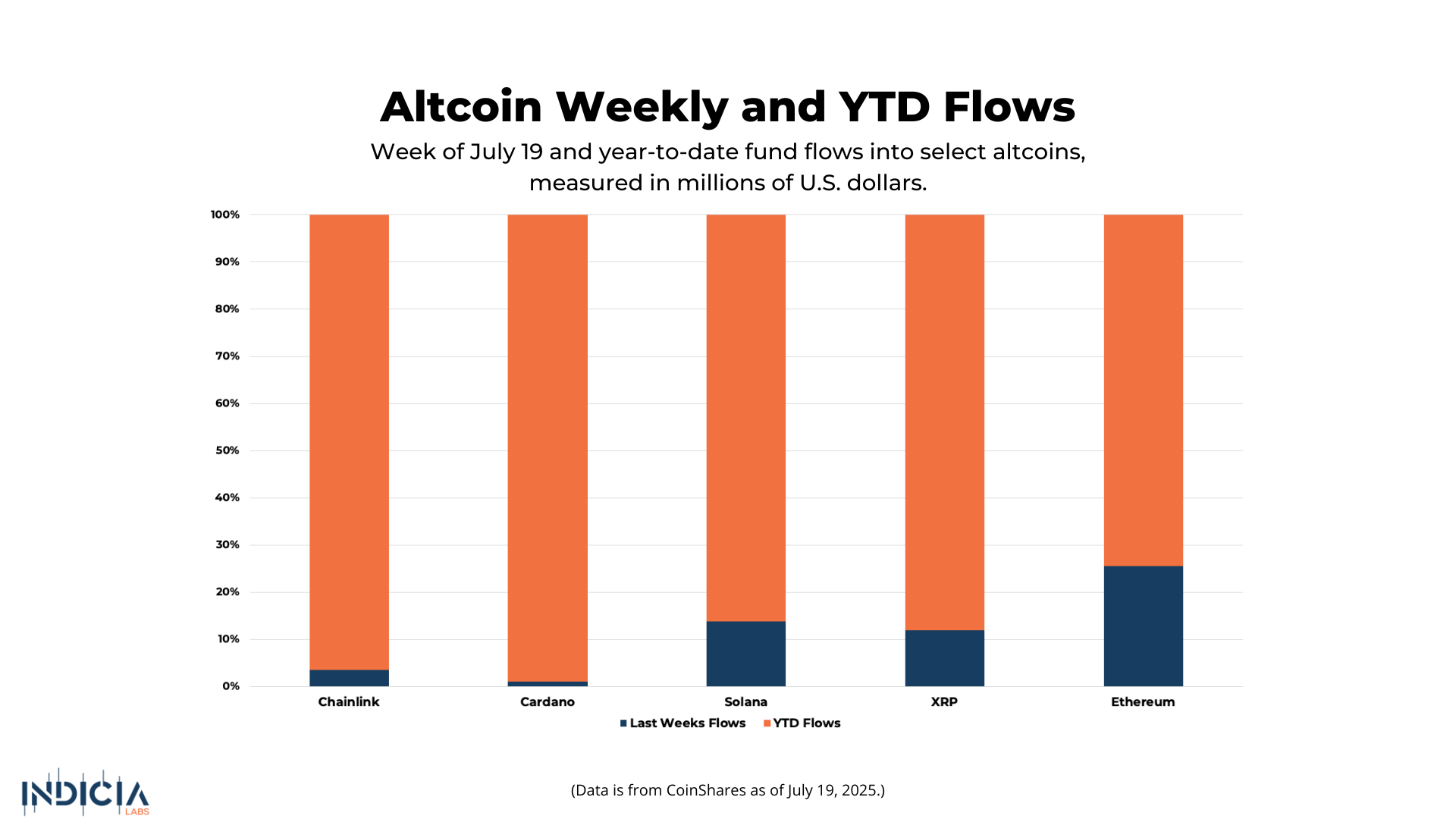

While the altcoin rotation is gaining steam, flows remain heavily concentrated in a few large-cap names. According to CoinShares, digital asset investment products attracted a record USD 4.39 billion in inflows last week—driven almost evenly by Bitcoin (USD 2.20B) and Ethereum (USD 2.12B). Total assets under management have now reached USD 220 billion, an all-time high.

Among altcoins, Ethereum clearly leads, with USD 6.2 billion in YTD inflows, reflecting mature institutional conviction. Solana continues to build momentum, pulling in USD 39.1 million last week and USD 153.7 million month-to-date. XRP and Sui also saw inflows of USD 36.1 million and USD 9.3 million, respectively.

However, participation beyond these names remains limited. Most altcoins outside the top tier showed minimal activity. Notably, despite XRP’s positive weekly inflows, its month-to-date flows remain negative (–USD 57.3 million).

The rotation is real, but it’s selective. Institutional flows are still focused on assets with regulatory clarity, treasury narratives, or ETF tailwinds. Broader participation across altcoins may follow, but for now, capital is moving with caution.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.