Sophia’s Thoughts on Ethereum’s Recent Run

Ethereum just rolled out its biggest upgrade since the Merge—what does it mean for ETH, the ecosystem, and the future of crypto?

These are Sophia's Thoughts:

Ethereum’s Pectra upgrade went live, bringing major improvements to staking, wallets, and Layer 2 scalability.

After months of stagnation, Ethereum needed a win—and Pectra delivered, backed by macro tailwinds and renewed developer focus.

Ethereum’s price rallied on the news and sentiment has been moving upwards. Developers believe that this may be a turning point for the blockchain.

Join IL Pro for free now and get access to Sophia and Pallas, our premier crypto intelligence solutions that have been helping investors trade like pros! Just tell us how you feel about crypto and let Indicia Labs do the rest. Use the offer code ILxYOU when signing up for IL Pro.

🚀 Last week’s market performance

The crypto market rallied hard this week, posting a double digit gain of 12.8%. Bitcoin (BTC) slightly underperformed the market, as alt-coins rallied, but still closed with a 8.4% gain. The best performing coin of the week was THORChain (RUNE), which gained 54.4% after rolling out a network upgrade. The worst performing coin this week was UNUS SED LEO (LEO) which fell 1.4% last week.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

📍Ethereum Just Got a Major Upgrade

Ethereum rolled out its most significant network update since the Merge in 2022. The long-awaited Pectra upgrade went live on May 7. It introduced a sweeping set of changes aimed at improving staking efficiency, wallet functionality, and Layer 2 scalability. ETH rallied over 40% from April lows, climbing from USD 1,800 to over USD 2,600, with the biggest surge coming right after the Pectra upgrade.

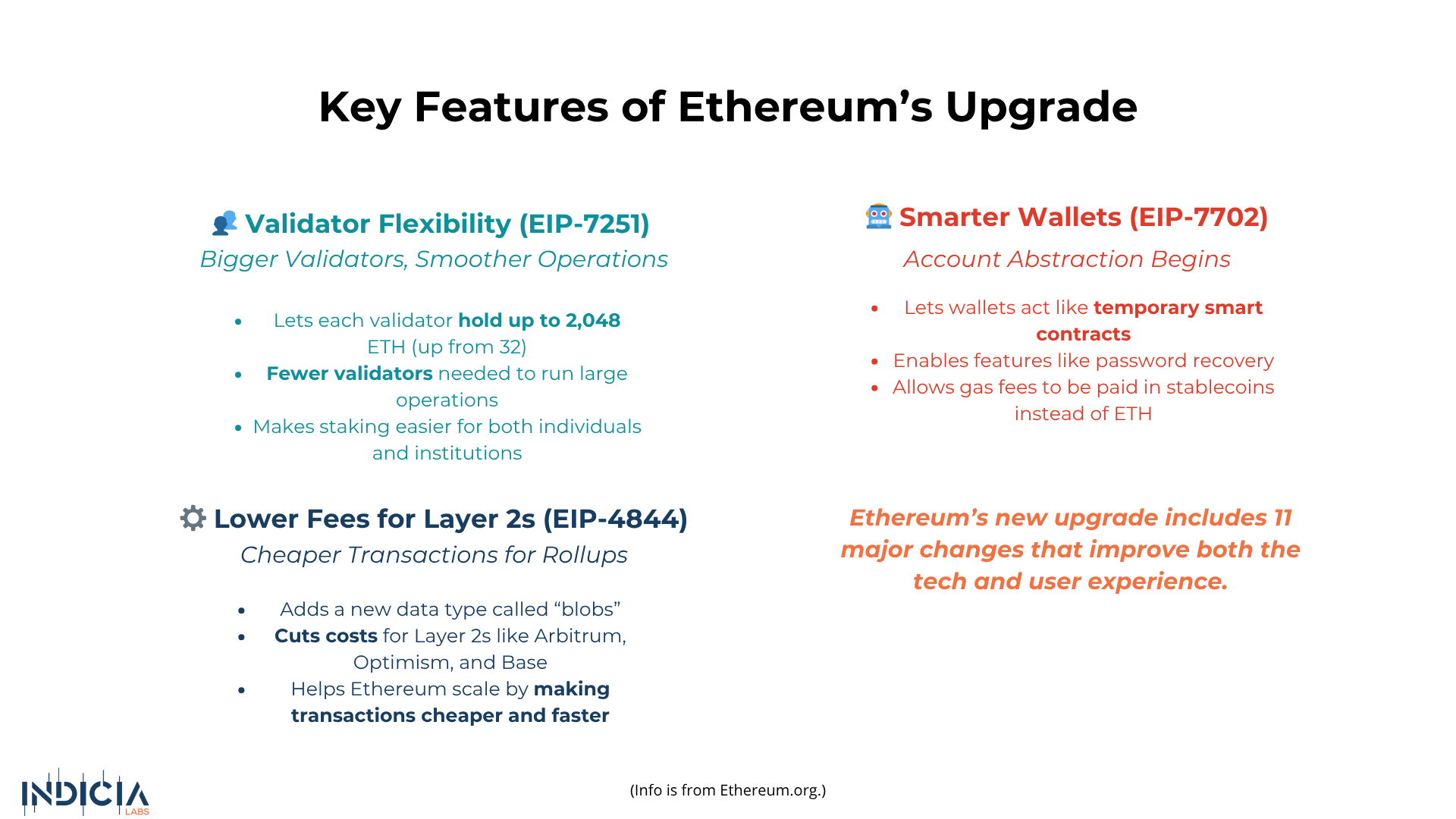

The upgrade includes 11 changes aimed at making Ethereum faster, cheaper, and easier to use. One of the biggest updates, EIP-7251, increases the limit on how much ETH each validator can hold—from 32 to 2,048 ETH. This makes it easier for both individuals and large operators to manage their staking more efficiently. Another major change, EIP-7702, was co-authored by Ethereum founder Vitalik Buterin. It gives wallets more flexibility by letting them act like smart contracts for a short time. This unlocks useful features like password recovery and the option to pay gas fees with stablecoins instead of ETH. Finally, EIP-7691 helps Ethereum handle twice as much data from Layer 2 networks like Arbitrum and Optimism, which means faster and cheaper transactions for users.

Despite earlier delays and failed testnets, the upgrade was finalized smoothly. Preston Van Loon, an Ethereum developer at Prysm, called it “the network’s most ambitious upgrade yet,” a sentiment that was reflected in the price action. As Presto analyst Min Jung noted, “ETH is finally catching up after lagging behind BTC for most of the year. The recent Pectra upgrade has helped restore some confidence.”

After months of criticism and stagnation, Ethereum is signaling a renewed push to stay competitive—and investors are responding.

🤔 Ethereum Needed a Win

Ethereum’s Pectra upgrade comes at a critical moment. Despite its dominance in smart contracts and decentralized apps, Ethereum has recently faced mounting pressure from faster, cheaper alternatives like Solana. Ethereum has underperformed Bitcoin for most of 2025, a trend that’s clearly visible in its declining price ratio against BTC. That ratio just saw its first meaningful bounce in months, coinciding with the Pectra upgrade.

Pectra tackles these issues directly by raising staking limits and making wallets easier to use. It also helps Layer 2 networks run faster and cheaper, improving Ethereum’s overall speed and user experience.

The rally wasn’t just about Ethereum, it also reflected broader macro tailwinds. Bitcoin reclaimed the USD 100K mark last week, and Ethereum’s gains came on the heels of improving global trade sentiment and the signing of a U.S.–U.K. trade deal. That momentum gave ETH the push it needed to break out of its slump.

Importantly, this upgrade is also a signal from the Ethereum Foundation. After months of criticism for moving too slowly, Ethereum’s developers are picking up the pace. The successful launch of Pectra and the early announcement of the next upgrade, Fusaka, shows a clear roadmap. The main Ethereum Improvement Proposal (EIP) of this upgrade is called “PeerDAS,” a change that could help the chain support larger amounts of transaction data. As Parithosh Jayanti of the Ethereum Foundation put it, “PeerDAS is super important since we want to help layer-2s scale.” That push for efficiency and speed is crucial if Ethereum wants to stay at the center of the crypto ecosystem.

🚀 Is This A Turning Point for Ethereum?

Ethereum’s price spiked over 25% on May 7 following the Pectra upgrade, its biggest one-day gain since May 2021. But beyond the short-term rally, this moment could represent a broader shift. After months of underperformance and developer fatigue, Ethereum is showing signs of renewed momentum—both in the developer sentiment and market perception. Sophia, our sentiment AI, picked up a steady rise in Ethereum sentiment leading up to the upgrade. That optimism was validated by the sharp surge in price once Pectra went live.

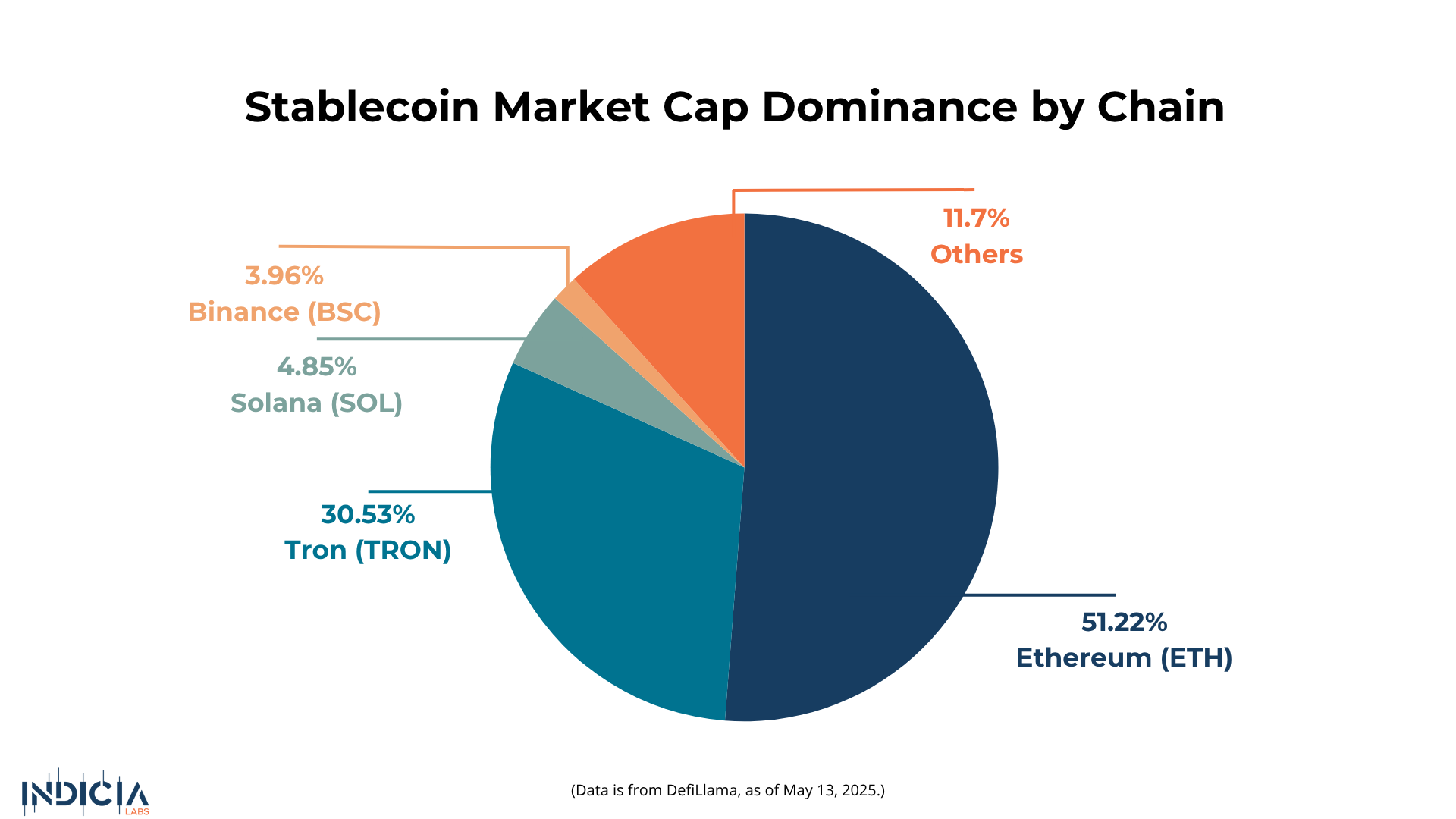

The upgrade’s impact goes far beyond ETH holders. With higher validator limits and more efficient data handling, staking services, Layer 2 platforms, and DeFi protocols stand to benefit directly. That’s especially relevant as Ethereum still holds 57% of all real-world tokenized assets, maintains over 50% stable coin dominance, and over USD 123 billion in stablecoins.

For Ethereum, this upgrade is more than a technical milestone. It’s a message: the chain is evolving, responsive, and determined not to be left behind.

Do you want to stay up-to-date on the latest crypto intelligence? Join Indicia Labs for free.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.