Sophia’s Thoughts on Institutional Demand

Bitcoin is seeing renewed interest, with ETF inflows surging, sovereign accumulation quietly continuing, and corporate and state players moving to build lasting crypto reserves.

These are Sophia's Thoughts:

Bitcoin saw a renewed wave of institutional demand last week with USD 3 billion in ETF inflows.

Corporations like Strategy and Twenty One Capital are deepening long-term Bitcoin holdings, while Arizona took another step towards becoming the first state in the U.S. with a crypto treasury.

As institutional strategies expand beyond Bitcoin into areas like Solana staking, the real test will be whether this interest holds steady in the face of volatility and regulatory uncertainty.

Join IL Pro for free now and get access to Sophia and Pallas, our premier crypto intelligence solutions that have been helping investors trade like pros! Just tell us how you feel about crypto and let Indicia Labs do the rest. Use the offer code ILxYOU when signing up for IL Pro.

🚀 Last week’s market performance

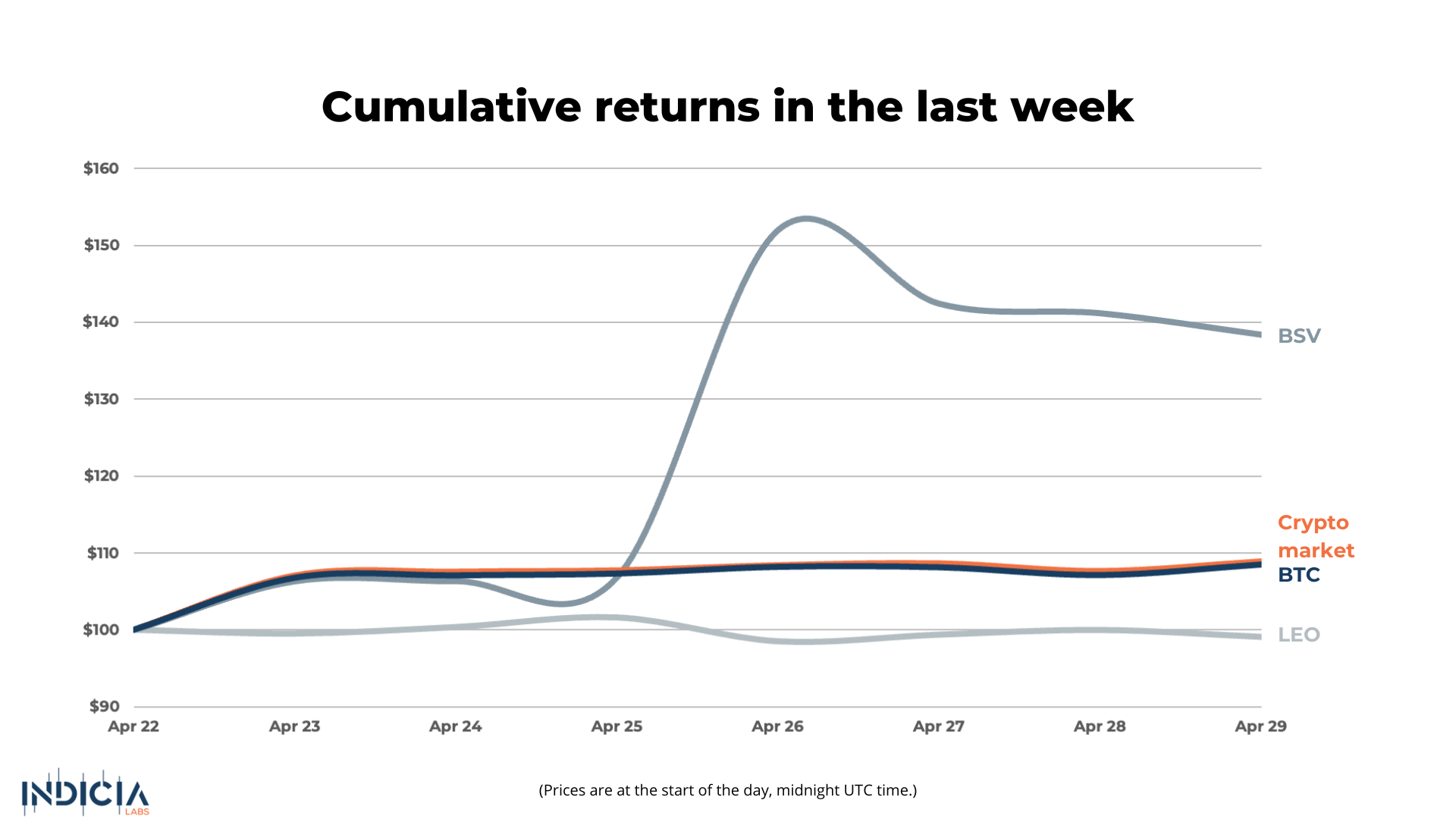

The crypto market gained another 8.9% this week, with Bitcoin (BTC) following close behind, with an 8.5% rise. The best performing coin of the week was Bitcoin SV (BSV), which gained 38.4%. The worst performing coin this week was UNUS SED LEO (LEO) which fell a mere 0.9% last week.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

🌊 Institutional and Sovereign Inflows

Last week marked one of the strongest institutional surges into Bitcoin since the launch of spot ETFs, with USD 3.06 billion in net inflows across U.S. spot Bitcoin ETFs. It was the first full week of uninterrupted inflows in over a month and the second-highest weekly total on record since the ETFs launched in January 2024.

BlackRock’s iShares Bitcoin Trust (IBIT) led the inflow wave, pulling in USD 1.45 billion, including USD 970 million on April 28. This marked its second-largest single-day investment since launch. IBIT now manages USD 54 billion in assets, representing nearly 51% of the spot Bitcoin ETF market. While asset managers are scaling exposure through ETFs, sovereign entities are also furthering their commitment to Bitcoin on the global stage.

On a global note, El Salvador has continued to build its strategic Bitcoin reserves, now totaling 6,161 BTC valued at approximately USD 584 million. Although the government paused direct purchases to comply with conditions tied to a USD 1.4 billion IMF loan in December, the country’s Bitcoin Office has quietly maintained a “one Bitcoin a day” strategy. President Bukele has publicly defended the policy, stating, “No, it’s not stopping,” in response to speculation that international pressure would force a reversal. Bitcoin is increasingly on the radar of serious allocators. Whether that attention turns into lasting exposure will depend on how institutions respond when the next wave of volatility hits.

🔮 Corporate and State Reserves

While some are already building exposure, there is an influx of corporations and governments working on establishing Bitcoin as a core balance sheet asset.

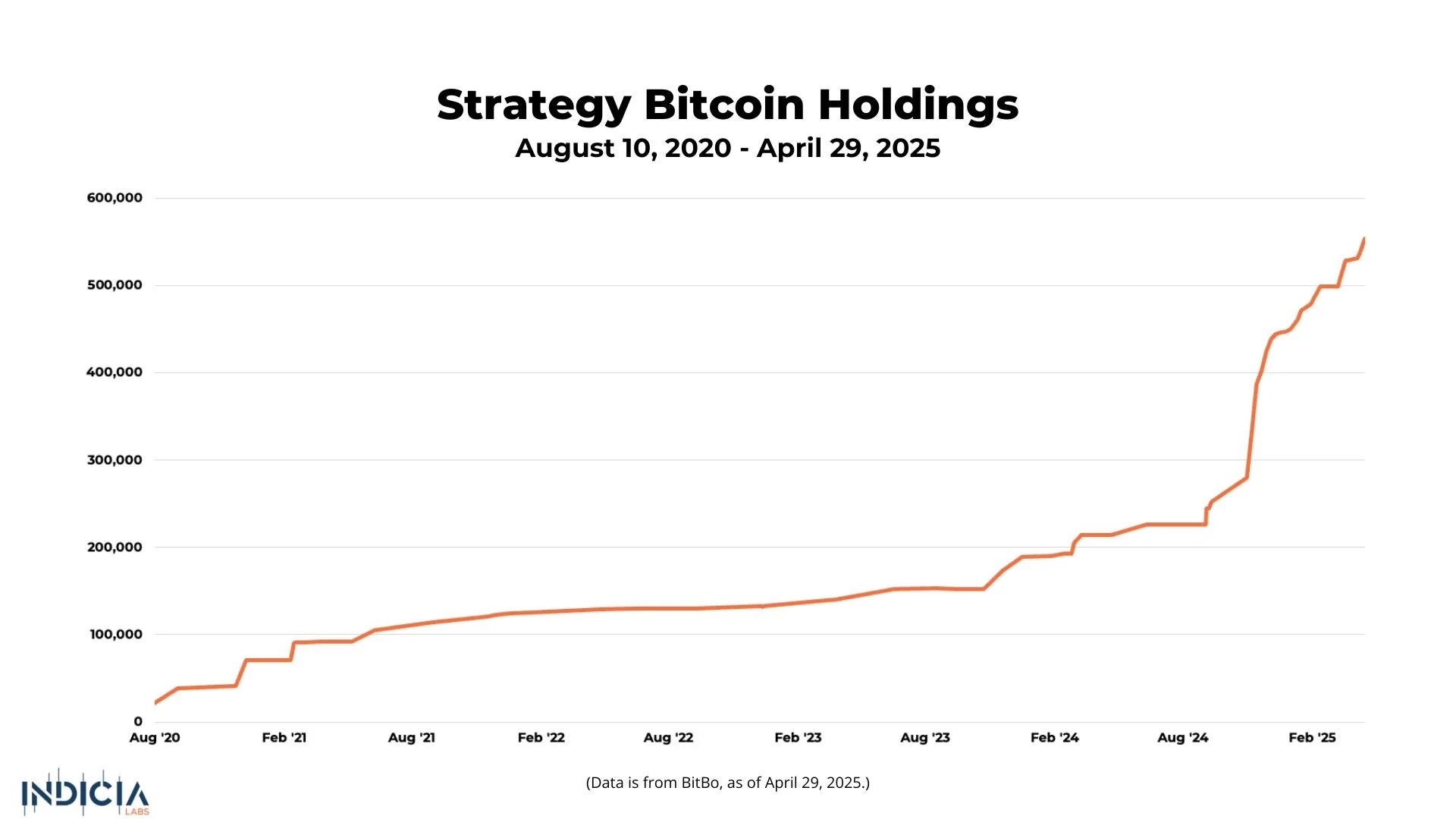

Strategy (formerly MicroStrategy) reaffirmed its leadership position this week, purchasing 15,355 BTC for USD 1.42 billion, bringing its total holdings to 553,555 BTC worth over USD 52 billion. Funded through stock offerings, this move fits within the company’s “21/21 Plan” to raise USD 42 billion over three years for continued Bitcoin acquisitions. While Strategy’s model has fueled stock appreciation, concerns remain around debt accumulation and dilution risk, particularly if Bitcoin’s volatility persists.

Adding new competition, Twenty One Capital officially launched last week, backed by Tether, Bitfinex, and SoftBank. With a 42,000 BTC goal valued near USD 3.6 billion, it will become the third-largest public Bitcoin treasury. Led by Strike CEO Jack Mallers, the company aims to create a Bitcoin-native investment platform, blending treasury management with media, financial services, and advocacy.

On the government side, Arizona’s legislature passed two Bitcoin reserve bills, SB 1025 and SB 1373, which would allow up to 10 percent of public funds to be allocated into Bitcoin and digital assets. Having passed both the Senate and House, the bills await Governor Katie Hobbs’ decision. If signed into law, Arizona would become the first U.S. state to formally integrate Bitcoin into its treasury strategy, setting a possible precedent for others.

Across corporate treasuries and state governments, the common theme is clear: Bitcoin is becoming embedded into long-term strategic planning.

🚀 The Road Ahead

As institutional adoption deepens, the coming months will reveal if these strategies are built on conviction.

On the adoption side, ETFs have unlocked Bitcoin exposure for a broader investor base, corporations are expanding crypto treasury models, and states like Arizona are setting legal frameworks for public sector crypto reserves. Key moments are looming: Arizona Governor Katie Hobbs’ decision on Bitcoin reserve legislation, Strategy’s “Bitcoin for Corporations” conference on May 6–7, and Twenty One reaching its target of 42,000 Bitcoin

Institutional strategies are also expanding beyond Bitcoin itself. SOL Strategies, a Canadian public company listed under CYFRF, recently secured a USD 500 million convertible note facility from ATW Partners to purchase and stake Solana (SOL) tokens. The structure uses staking yields to service debt obligations, creating a capital-efficient way to scale validator operations. CEO Leah Wald described it as the largest staking-focused financing in the Solana ecosystem to date. Moves like this show that institutional crypto strategies are broadening into proof-of-stake ecosystems and blockchain infrastructure. However, success will still depend heavily on network stability, adoption, and macro market sentiment.

Bitcoin’s price has rebounded in recent weeks, supported by strong ETF inflows, but its volatility remains a constant factor. While institutional interest has increased, sustained participation will likely depend on how these structural issues evolve and how markets respond to future price swings.

Do you want to stay up-to-date on the latest crypto intelligence? Join Indicia Labs for free.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.