Sophia’s Thoughts On Macro Data And Index Fallout

Markets are entering a critical stretch defined by missing economic data, rising rate-cut expectations, and a looming structural decision that could reshape corporate Bitcoin demand.

These are Sophia's Thoughts:

With government data only now returning after the shutdown, the Fed heads into its December 9–10 meeting with stale labor and inflation figures.

MSCI’s review of Strategy (MSTR) has put billions in passive flows at risk and exposed a structural pressure point for Bitcoin.

The path forward hinges on updated macro prints and MSCI’s January ruling, leaving both markets cautious into year-end.

🚀 Last week’s market performance

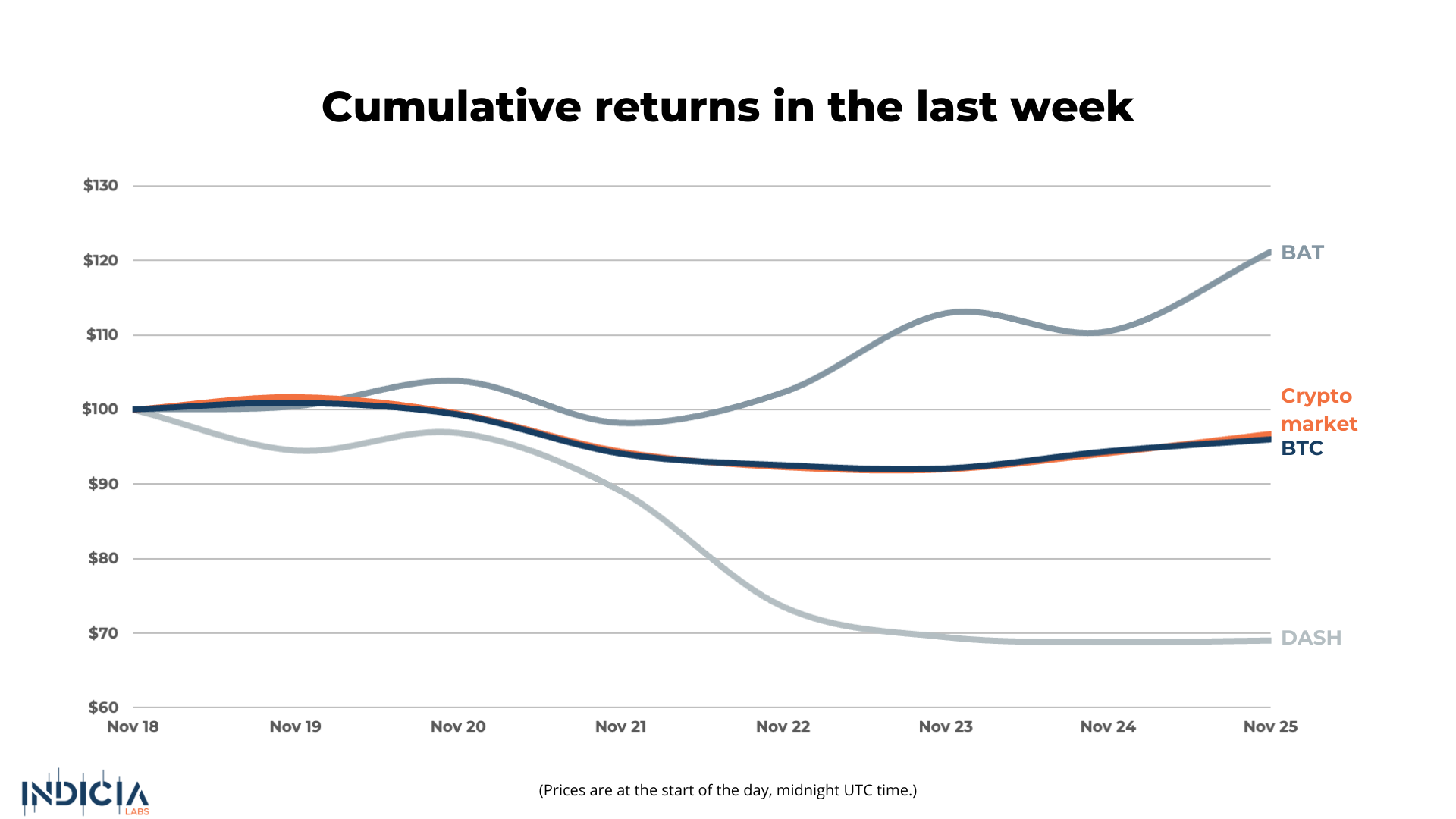

The crypto market fell 3.2% this week as risk assets continued to trade cautiously. Bitcoin (BTC) declined 4.0%, extending its recent pullback. Basic Attention Token (BAT) was the standout performer, rising 21.2%, while Dash (DASH) was the week’s worst performer, dropping 30.9% after unwinding a sharp prior rally.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

🛩️ Fed is Flying Blind

With the government shutdown finally over, the flow of official U.S. economic data is only now starting to come back online. For almost two months, markets have been operating in the dark, and so has the Federal Reserve. The central bank is heading into its final meeting of the year on December 9-10 with lagged and stale information, which is a rare and uncomfortable position for a policy body that depends on real-time indicators to justify its decisions.

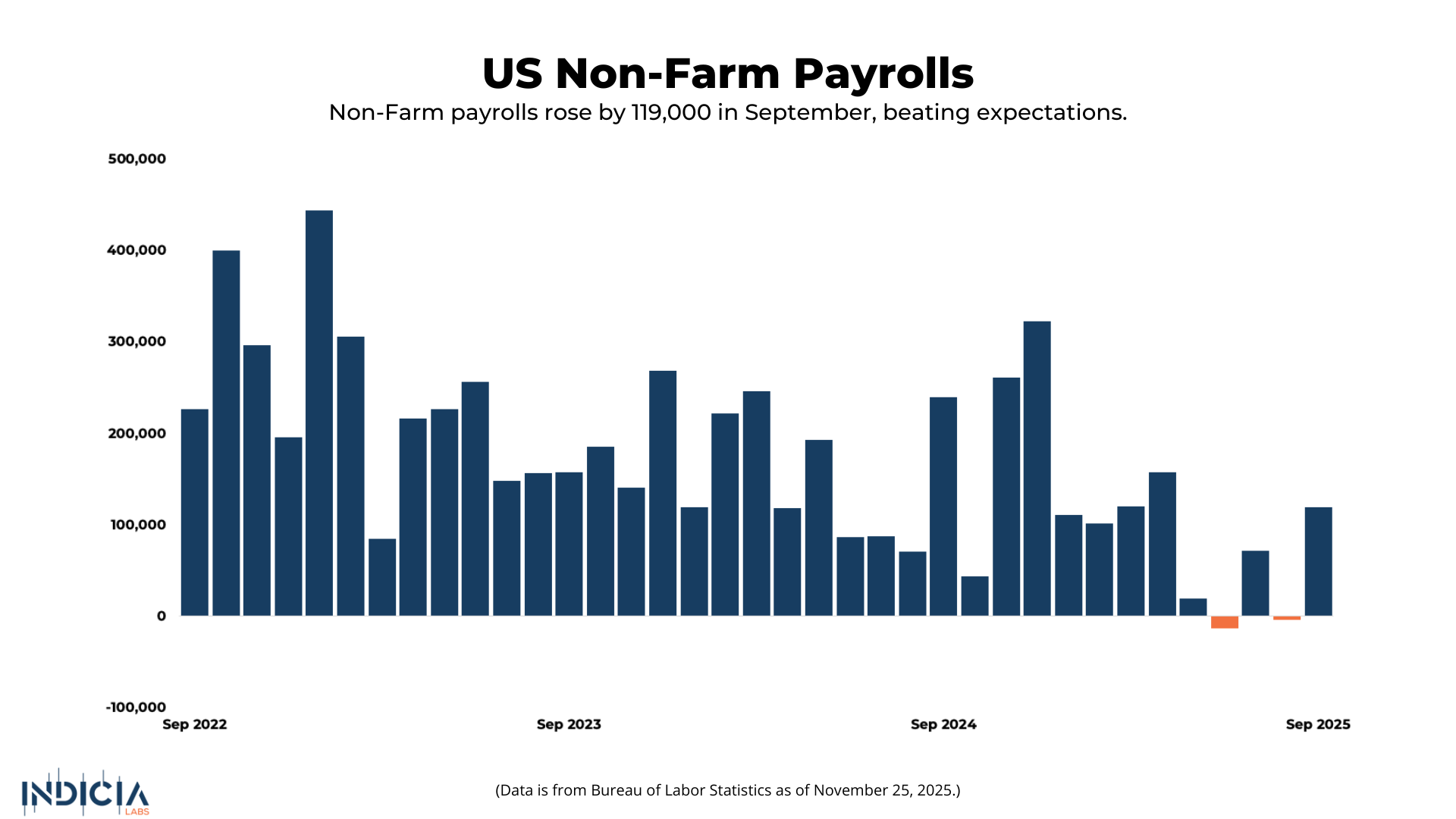

The first major release after the shutdown was the September jobs report. It is outdated, but in a data blackout even outdated numbers shape expectations. The unemployment rate edged up from 4.3% to 4.4%, a small move but part of a steady upward trend that has been building for months. Payroll growth came in stronger than expected at 119,000, although the strength was not broad. Most of the gains came from the same two sectors that have carried the labor market throughout the year: Education and Health, and Leisure and Hospitality. Hiring elsewhere was soft or flat.

Jobless claims painted a similar picture. New claims were lower than forecasted but at the same time, continuing claims continue to rise, showing that once people lose jobs they are finding it more difficult to secure new ones. The labor market is not breaking, but it is losing momentum at the margins, and the Fed is about to set policy using data that does not fully reflect current conditions.

Because of this uncertainty, markets have turned more cautious. The expected probability of a December rate cut fell to 50% last week before rebounding to 83%. Until fresh, real-time data fills the gap, both the Fed and investors are navigating with only partial visibility.

⚡ The MSTR Shock Is the Real Story

While macro has been defined by missing data, the real driver in crypto this week is the structural risk facing digital-asset treasury companies, with Strategy (MSTR) at the center. MSCI’s proposal to classify these firms as “funds” rather than operating companies would force major equity indices to remove them, triggering automatic selling from the passive vehicles that track those benchmarks. It is a technical rule change with direct market consequences.

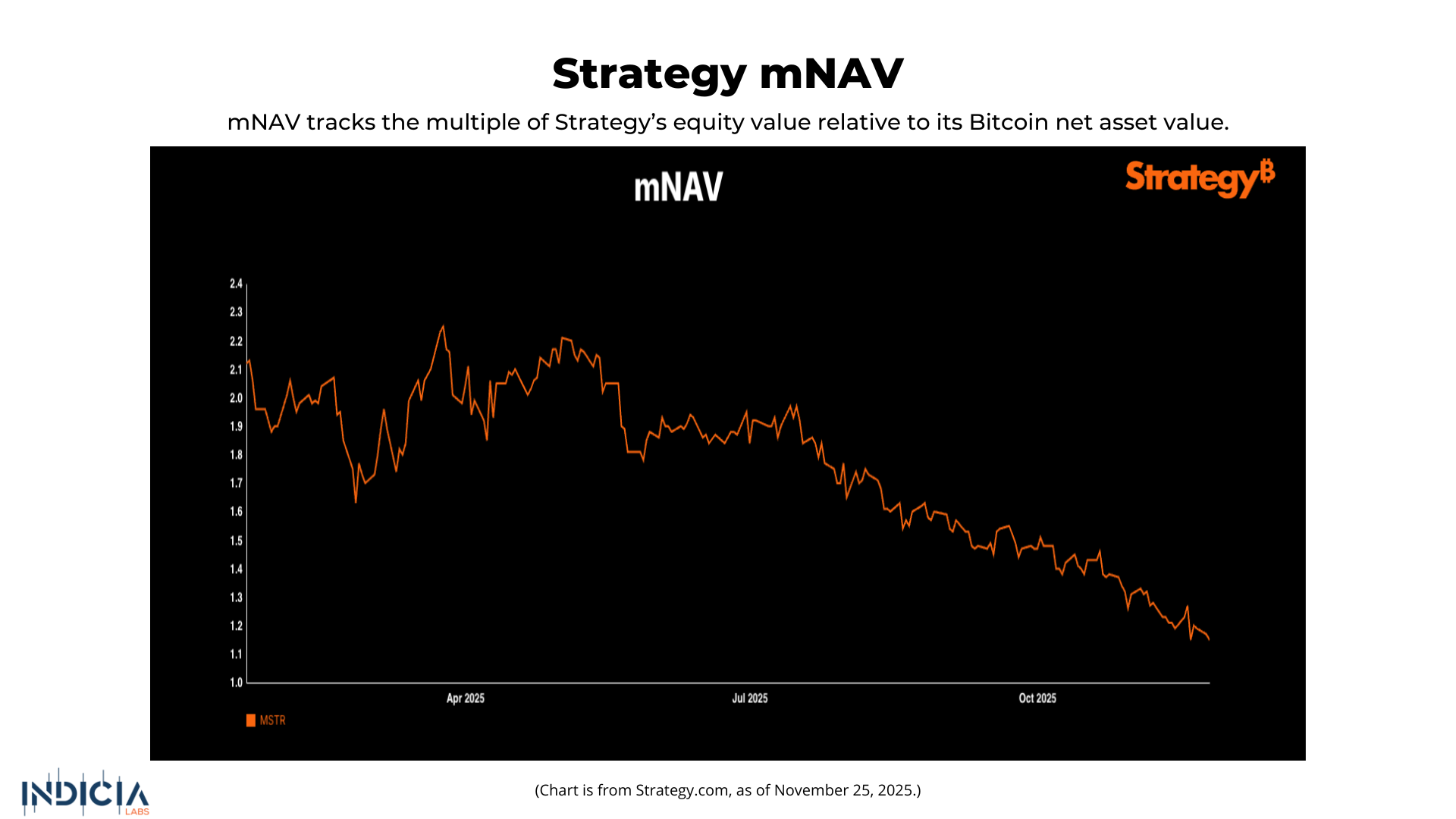

The scale of exposure explains the sensitivity. Strategy sits inside the Nasdaq-100, MSCI USA, and MSCI World, with roughly nine billion dollars of its market value held in index-tracking funds. JPMorgan analysts, led by Nikolaos Panigirtzoglou, noted that MSTR’s share price has fallen faster than Bitcoin as its valuation premium, “viewed by some investors as unjustified,” has sharply compressed. They argue the recent slide reflects rising concern that the company may be removed from major indices, estimating that exclusion from MSCI alone could cause USD 2.8 billion in forced outflows and as much as USD 8.8 billion more if other providers follow.

This backdrop has also reframed how the October 10 crash is being interpreted. Analysts at Bitcoin For Corporations claim the sell-off was amplified by the resurfacing of a 42-day-old JPMorgan note about potential index risk, which they argue helped accelerate a USD 19 billion liquidation cascade. Their timeline points to a series of pressure events: margin hikes on MSTR positions in July, renewed concern in September about companies adopting the “Saylor playbook,” and MSCI extending its consultation minutes before the tariff announcement that triggered the flash crash. Q3 filings add further context: JPMorgan, BlackRock, and Vanguard collectively sold over five billion dollars of MSTR shares during the quarter, with JPMorgan alone unloading roughly 25 percent of its position ahead of the MSCI ruling.

Saylor responded directly, stating in his “Response to MSCI Index Matter” that MicroStrategy is an operating company with software revenue and BTC-backed credit products, not a fund, and that MSCI’s classification does not define the company’s strategy or mission.

Digital-asset treasury companies rely on stable access to equity markets to fund Bitcoin accumulation. Any disruption to that access weakens the feedback loop that has fueled one of the largest sources of incremental BTC demand over the last five years.

💹 A Market Waiting for Real Data and a Real Decision

The next several weeks bring two major developments: the return of delayed U.S. economic data and MSCI’s ruling on whether digital-asset treasury companies remain in major equity indices. Both unfold between December and mid-January and will shape how markets position into early 2026.

On the macro side, the Fed will make its final policy decision of the year using labor and inflation data that lag the shutdown period. That puts greater weight on every release leading into the December meeting. Rate-cut odds, which had softened earlier, have now moved sharply higher as traders reassess the Fed’s visibility. Until the full data cycle normalizes, markets are operating with limited clarity.

In crypto, the focus is the January 15 MSCI ruling. The outcome determines whether companies like Strategy remain in indices such as the Nasdaq-100, MSCI USA, and MSCI World. Removal would trigger mechanical outflows and reduce the company’s ability to raise capital at scale. A delay or grandfathering would avoid that scenario and keep existing dynamics in place.

Bitcoin’s price levels sit directly in this cross-current. Strategy’s average acquisition cost of roughly USD 74,400, along with collateral considerations below USD 70,000, means BTC levels now influence the company’s liquidity profile and financing capacity. The outlook is defined by updated macro data and the MSCI decision. As those arrive, visibility will improve for both the Fed and crypto markets. Until then, positioning remains cautious as the year closes.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.