Sophia’s Thoughts On The Leading Cryptos

ETF flows and corporate treasuries are shaping a new phase of institutional crypto adoption, with Bitcoin holding steady, Ethereum accelerating, and Solana quietly building its base.

These are Sophia's Thoughts:

Ethereum dominated ETF inflows with a record USD 1.018B single-day creation, Bitcoin reversed early-month outflows to stabilize near USD 119K, and Solana’s modest flows hint at early institutional interest.

Ethereum treasuries surged by 1.5M ETH in 30 days, Bitcoin companies continued steady accumulation, and Solana treasuries embraced staking-heavy strategies to compound returns.

The combination of ETF demand and treasury growth is creating a reflexive loop of capital and price momentum, with Ethereum currently leading in both speed and scale.

🚀 Last week’s market performance

The crypto market rose 4.6% this week, led by a 3.2% gain in Bitcoin (BTC) as sentiment improved across major assets. Pendle (PENDLE) was the top performer, surging 34.4% on momentum from its new trading initiative, Boros. On the downside, Monero (XMR) fell 12.5% as escalating security risks prompted investors to exit positions.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

🥉 3 Crypto Assets Leading ETF Flows

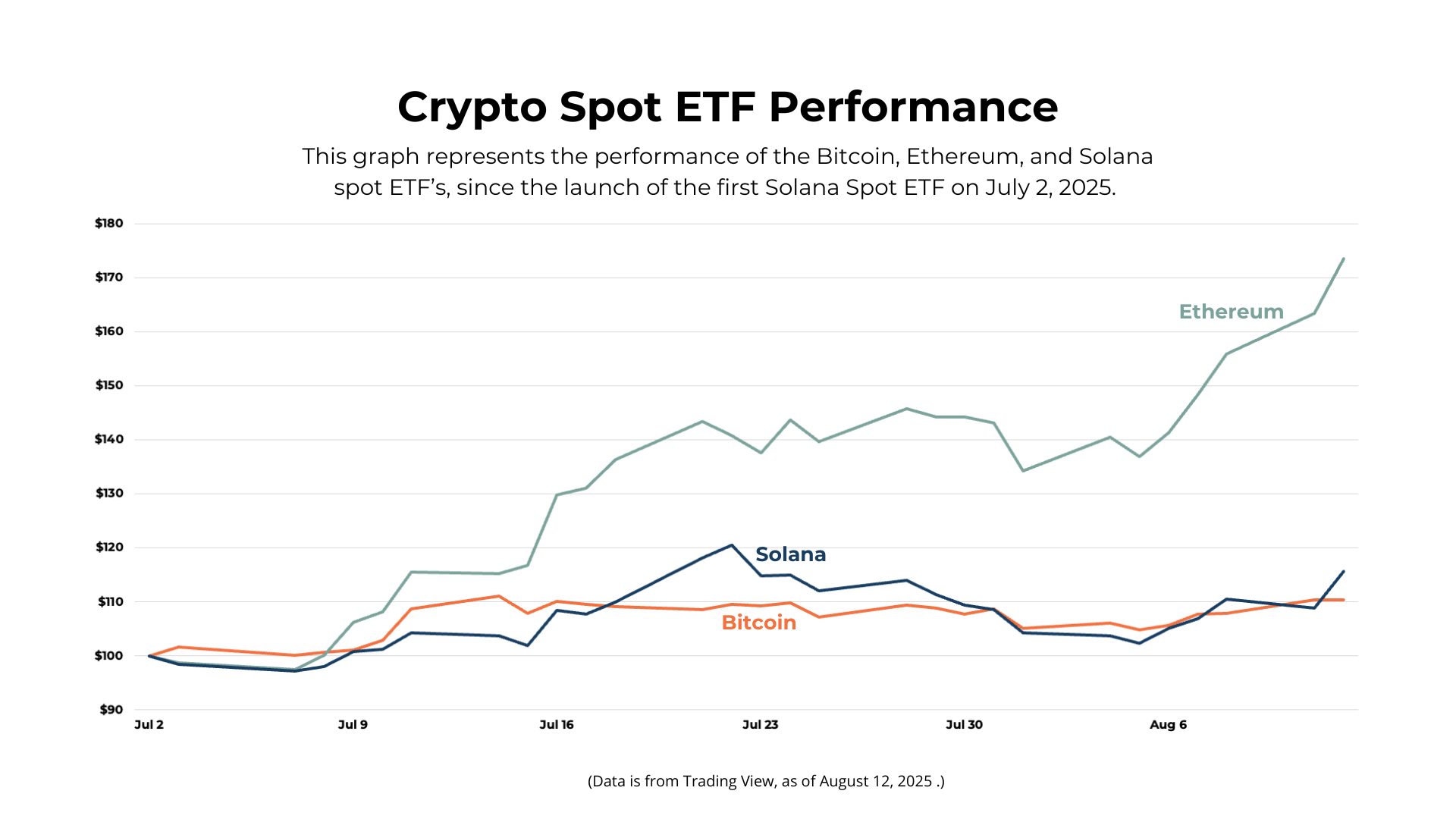

Spot ETF flows this week painted a clear picture of where institutional appetite is concentrated: Ethereum is surging ahead, Bitcoin has regained stability after early-month turbulence, and Solana is still in its discovery phase.

After a rocky start to August with ~USD 1.3B in early outflows, U.S. spot Bitcoin ETFs reversed course in the second week. Between August 6–12, they pulled in USD 951M in net inflows, led by BlackRock’s IBIT, with three consecutive days above USD 100M. The inflows helped stabilize and recover BTC’s price to around USD 119K, muting further downside and reinforcing the idea that steady ETF demand can act as a structural price floor. Year-to-date, BTC spot ETFs have now attracted over USD 20B.

Ethereum ETFs decisively stole the spotlight. From August 6–12, they saw USD 1.737B in net inflows, capped by a record USD 1.018B in a single day on August 11. This marked the first time ETH ETFs had crossed the billion-dollar daily threshold. BlackRock’s ETHA alone brought in USD 639.8M that day. This extended ETH’s streak to 15 consecutive weeks of positive flows, a run unmatched in the crypto ETF space. Combined with aggressive corporate treasury accumulation, this ETF bid is fueling ETH’s 21% weekly rally and 45% MTD climb.

Solana’s newly launched spot ETFs remain quiet on the flow front, with net activity concentrated in futures and leveraged products. The week saw only USD 3.7M in net inflows, most of it on August 11–12, bringing the total flows since launch in early July to around USD 140M. While modest compared to BTC and ETH, the launch has put Solana on institutional radar, and growing corporate treasury positions suggest spot ETF flows could accelerate once the market matures.

The takeaway: BTC’s inflows are reinforcing stability, ETH is riding a reflexive loop of ETF demand and price momentum, and SOL’s institutional phase-in is underway. Its ETF flows may be small today, but the strategic positioning is starting to form.

🛞 Corporate Treasuries: The New Demand Flywheel

If ETFs are the public face of institutional adoption, corporate treasuries are the engine room, and that engine is revving fastest for Ethereum. Bitcoin companies continue to add methodically, while Solana’s treasuries are smaller but evolving into yield-driven balance-sheet strategies.

Ethereum treasuries have grown rapidly over the past 30 days, adding roughly 1.5M ETH (about USD 6.5B). Leading the charge is BitMine Immersion Technologies, which now holds 1.15M ETH (around $5B) and has filed to raise up to $20B to target a 5% share of all ETH in circulation. SharpLink Gaming, The Ether Machine, BTCS, Bit Digital, and GameSquare have all expanded positions, with total public-company ETH holdings now exceeding 2.1M ETH. Many are staking or restaking for 3–5% base yields, while select firms like GameSquare aim for 8–14% through blue-chip DeFi strategies. This “NAV-per-share growth” model mirrors MicroStrategy’s Bitcoin playbook but with a yield engine attached.

Public BTC treasuries have amassed USD 113 billion to date, led by MicroStrategy, Marathon Digital, and XXI. The strategy here is straightforward: issue equity, buy BTC, and hold. There’s no native yield and fewer operational complexities, but the simplicity makes it easy for investors to understand and for companies to execute without taking on protocol-level risk.

Corporate Solana holdings are still small compared to BTC and ETH, but the growth rate is notable. Upexi leads with roughly 2.0M SOL (about USD 340M) staked at an 8% yield, joined by DeFi Development with 1.3M SOL, SOL Strategies with 420k SOL, and Torrent Capital with 40K SOL. These treasuries are designed as active assets: staking, running validators, and in some cases raising dedicated credit lines to expand holdings. Advisory moves, like Arthur Hayes of Deutsche Bank and Citigroup joining Upexi, signal a more institutional, brand-driven approach to SOL treasury building.

Bitcoin treasuries remain a pure scarcity play. Ethereum treasuries are maturing into yield-compounding machines. Solana treasuries are experimenting with active, yield-driven structures that could scale quickly if ETF flows pick up. In all three cases, the model is reflexive: higher prices boost equity valuations, enabling more capital raises, which in turn fund more crypto purchases.

💡 What This Means for Crypto

The combination of ETF inflows and corporate treasury accumulation is creating powerful, self-reinforcing demand loops across Bitcoin, Ethereum, and Solana. For Bitcoin, steady ETF inflows and disciplined treasury additions are acting like a structural bid, dampening downside risk and providing a base for gradual appreciation.

Ethereum’s model is more aggressive: record-setting ETF demand pairs with treasury strategies designed to grow holdings through staking, restaking, and selective DeFi participation. That dual engine, flows plus yield, appears to give ETH the highest upside torque but also introduces operational and smart contract risks. Solana’s approach is still in its early stages, but it’s distinct: treasuries are smaller in size yet built to be active, staking-heavy, and validator-driven, turning token holdings into productive assets from day one.

The near-term watchlist centers on whether ETH’s billion-dollar ETF creation day becomes a repeatable event, how much of these treasuries remain in staking versus migrating into DeFi, and whether Solana’s corporate holders can scale their positions before significant ETF-driven inflows arrive. Macro conditions matter too. Easing financial conditions could amplify these loops, while risk-off environments may expose the more leveraged or yield-seeking treasury models.

The takeaway: ETF products are drawing institutions in, but treasuries are keeping them engaged. If both channels continue to expand in tandem, the result could be a structural shift in crypto’s demand base.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.