Sophia’s Thoughts On Ethereum’s Progress

Despite muted price movement, Ethereum is entering a pivotal phase of growth. It has been advancing its fundamentals, deepening institutional adoption, and strengthening its technical foundation.

These are Sophia's Thoughts:

Despite sideways prices, Ethereum continues to lead in RWA activity and staking growth, supported by strong on-chain accumulation and elevated sentiment levels.

Institutions are increasingly treating ETH as core infrastructure, with ETF inflows, treasury allocations, and staking adoption all reinforcing Ethereum’s utility as programmable capital.

Ethereum developers are advancing upgrades like EIP-7983 to make the network more scalable and secure, while innovations in staking are building a more capital-efficient security model.

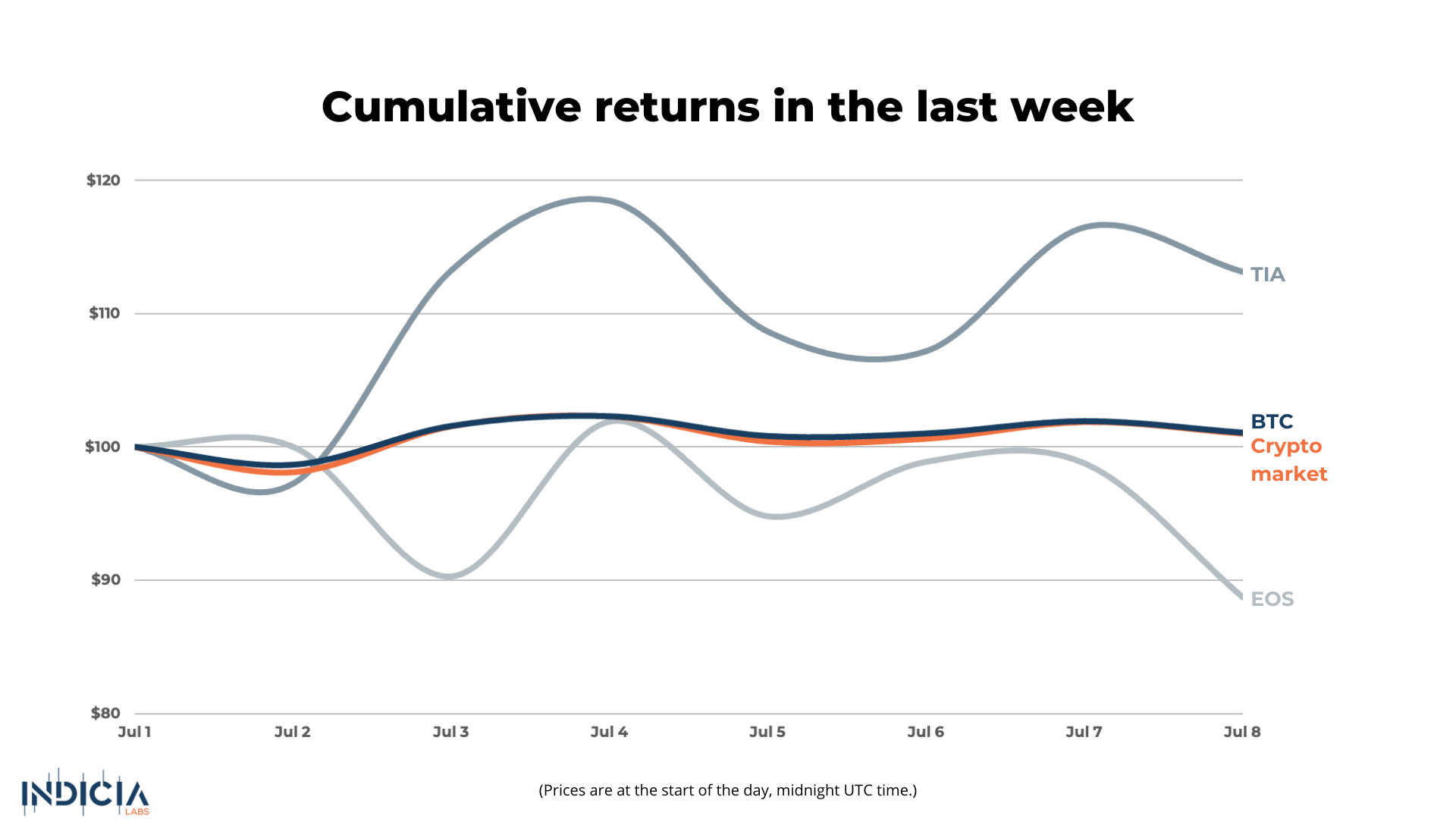

🚀 Last week’s market performance

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

⛽ The State of Ethereum

While the summer months often bring about a quieter market, developers on Ethereum have not taken any time off. Despite the rangebound price action between USD 2,200 and USD 2,800, Ethereum’s fundamentals continue to strengthen beneath the surface. The network dominates the Real World Asset (RWA) sector, processing the majority of tokenized treasury, credit, and equity flows. Currently, this represents around 57% of total RWA activity. Staking continues to expand, with over 35 million ETH now locked, reinforcing Ethereum’s role as a yield-generating base layer.

On-chain behavior is also signaling long-term conviction. Addresses holding more than 10,000 ETH have increased their holdings by over 9% since October 2024, bringing total “mega whale” supply to 41 million ETH, levels not seen since 2020. Sophia’s sentiment data reveals that sentiment has remained elevated the past couple months, reinforcing the picture of investor confidence despite a lack of price action.

⚒️ Institutional Adoption Is Accelerating Ethereum’s Utility

Traditional finance is also deepening its exposure to Ethereum through sustained allocation and infrastructure buildout. ETH-focused ETFs have now recorded eight straight weeks of net inflows, a rare signal of consistent demand. Several issuers are also preparing proposals to integrate staking into their ETF structures, converting these products from passive trackers to active yield-generating instruments, similar to the one recently launched for Solana.

Public companies are following suit. Bit Digital has transitioned to an Ethereum-centric treasury strategy, now holding over 100,000 ETH. SharpLink Gaming has gone even further, acquiring over 205,000 ETH and deploying the entire balance into staking and restaking protocols. These moves frame Ethereum not just as a digital asset, but as programmable treasury capital—productive, yield-bearing, and core to long-term financial strategy.

In parallel, new filings like the Truth Social “Crypto Blue Chip” ETF give ETH a fixed allocation alongside BTC and SOL, reflecting growing confidence in Ethereum’s structural importance. With regulatory headwinds easing, most notably the Fed’s removal of “reputational risk” barriers, institutions are gaining the green light to move capital into crypto infrastructure.

🪨 Ethereum’s Technical Foundation

While headlines tend to spotlight ETF flows and institutional adoption, Ethereum’s most important developments may be happening under the hood. The network’s engineers are quietly pushing forward upgrades that aim to make Ethereum more modular, predictable, and scalable.

One major proposal now gaining traction is EIP-7983, introduced by Vitalik Buterin and researcher Toni Wahrstätter. The change would limit how much gas a single transaction can use—setting a cap at 16.77 million, which is about one-sixth of an entire block. This might sound technical, but it has major benefits. It helps protect Ethereum from spam attacks, makes fees more predictable, and makes it easier for rollups and other tools to work with the network. It also pushes developers to split large transactions into smaller parts, which fits with Ethereum’s long-term plan to become more modular and scalable.

At the same time, the staking layer is evolving, becoming more capital-efficient and institutionally integrated. Restaking protocols like EigenLayer allow staked ETH to secure additional services beyond the base chain, while enterprise validators and infrastructure providers are making it easier for institutions to participate in securing the network. These advancements are turning Ethereum into a more dynamic, yield-generating base layer, without compromising its decentralization or security model.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.