Sophia’s Thoughts On Solana’s Institutional Breakthrough

Institutional doors are finally swinging open for Solana, and last week showed just how fast that hinge can move. What all is taking place, and what milestones still lie ahead?

These are Sophia's Thoughts:

The REX-Osprey Solana + Staking ETF has become the first U.S. crypto fund to offer staking rewards, while at least nine other spot Solana ETF applications are under review.

Institutions like Purpose Investments and DeFi Development Corp are adopting Solana for staking through Gemini Custody, while tokenized equities through Kraken are expanding Solana’s role in real-world asset infrastructure.

With ETFs gaining traction, staking infrastructure maturing, and tokenized assets going live, Solana is emerging as a key blockchain for institutional crypto adoption and financial integration.

🚀 Last week’s market performance

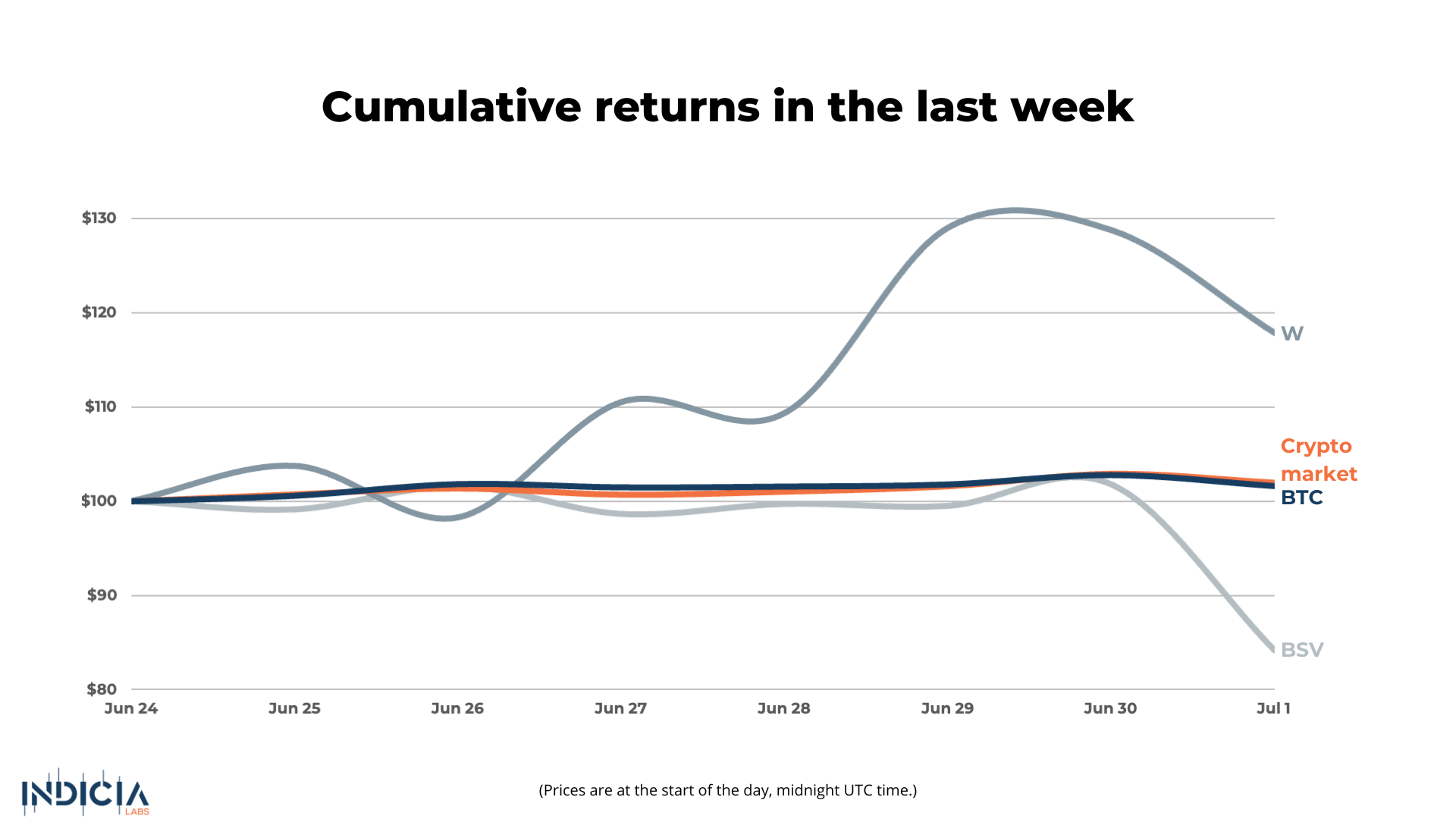

The crypto market bounced back this week, with Bitcoin (BTC) up 1.6% and the broader market gaining 2.0%. Wormhole (W) led the way with a 17.8% surge after being integrated into Ripple’s XRP Ledger. On the downside, Bitcoin SV (BSV) fell 15.9% amid renewed volatility.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

1️⃣ Solana Gets Its First U.S. Staked ETF

Solana just notched a major milestone in its institutional adoption journey. On Wednesday, REX Shares and Osprey Funds are launching the REX-Osprey Solana + Staking ETF. This is the first U.S.-listed cryptocurrency fund offering direct exposure to Solana with on-chain staking rewards.

Unlike traditional spot ETFs that rely on a commodity trust structure, the REX-Osprey Solana + Staking ETF is registered under the Investment Company Act, structured as a C-corporation, and holds SOL through a Cayman Islands subsidiary. At least 50% of its holdings will be staked, giving investors direct access to crypto-native yield while keeping the fund compliant with U.S. regulations.

In contrast, several other pending Solana ETF filings by 21Shares, Bitwise, Fidelity, Franklin Templeton, Grayscale, VanEck, Canary Capital, and CoinShares primarily follow a commodity trust structure and are registered under the Securities Act. While many of these include staking provisions in their updated S-1s, they do not necessarily use a C-corp structure or offshore subsidiaries, and custodial details vary by issuer. These ETFs are currently under SEC review and are widely expected to receive approval within the next month or two, according to Bloomberg analysts.

This launch comes after months of regulatory back-and-forth. The SEC had previously pushed back on staking structures, but recent communication confirmed it had “no further comments” on the fund, clearing the way for the first U.S. staked ETF to hit the market.

The market reacted swiftly. Solana’s price rose sharply from from the low-USD 140s to above USD 160, following the announcement, but has now cooled off as the market anticipates the actual launch. Analysts now see this fund as a strategic attempt to front-run the nine pending spot Solana ETF applications, which are still under review by the SEC. Bloomberg’s Eric Balchunas and James Seyffart recently raised the probability of Solana spot ETF approval to 95%, citing the success of Bitcoin and Ethereum ETFs and growing institutional demand for staking-based products.

While this isn’t a spot ETF in the pure regulatory sense, it’s a significant bridge. It’s one that could open the door for broader adoption of staking yield products across U.S. markets.

🪙 Institutional Staking and Tokenization

Beyond ETFs, Solana is rapidly becoming the backbone for institutional staking strategies and tokenized asset infrastructure.

Last week, Gemini expanded its custody services to offer institutional-grade Solana staking. The product allows ETFs, corporate treasuries, and high-net-worth individuals to stake SOL while keeping assets in segregated cold storage. Clients can delegate to a validator of their choice, or use Gemini’s own, introducing flexibility and control rarely seen in institutional crypto infrastructure.

Two major players have already adopted the solution.

Purpose Investments, a leading Canadian asset manager, launched the SOLL ETF in April 2025 on the Toronto Stock Exchange. The fund offers physical exposure to SOL and accrues staking rewards directly into the fund.

DeFi Development Corp (NASDAQ: DFDV), a publicly traded Solana treasury company, recently secured a USD 5 billion credit line to expand its SOL holdings. It now stakes its assets via Gemini Custody, highlighting how staking has become a core feature of corporate treasury strategy.

As Gemini’s Head of Institutional Product noted, “the ability to stake while maintaining control over validator selection is a game-changer.” It allows institutions to align staking strategies with their infrastructure partners without sacrificing custody-grade security.

What we’re seeing is the convergence of institutional-grade infrastructure with crypto-native mechanics; staking, tokenization, and custody, all built on Solana. It is becoming increasingly evident that Solana is fast becoming a foundation for the next generation of crypto markets.

🛞 The Institutional Flywheel Is Spinning

The convergence of ETFs, institutional staking, and tokenized equities isn’t just bullish for Solana, it signals a structural shift in how traditional finance is beginning to interact with blockchain infrastructure.

More than nine Solana spot ETF applications are currently pending before the SEC, and Bloomberg analysts now put the odds of approval at 95%. While it’s clear that spot ETFs alone don’t drive price, the chart below shows how the launch of Bitcoin’s ETF catalyzed a sustained uptrend—suggesting that for certain assets, institutional access can act as a powerful accelerant.

At the same time, tokenization is scaling. Kraken’s xStocks platform, built on Solana, now offers over 60 tokenized U.S. equities and ETFs, including Apple, Tesla, and Nvidia. These Solana-based assets are not only tradeable but fully composable within DeFi, enabling lending, collateralization, and synthetic strategies at near-zero cost.

Solana’s high throughput, low fees, and composability are giving it a clear edge as a base layer for real-world asset integration. In just the first half of 2025, the tokenized real-world asset (RWA) market reached USD 50 billion in value. That number is expected to hit USD 2 trillion by 2030. With products like xStocks and staked ETFs gaining traction, Solana is quickly positioning itself at the center of that growth.

The big question now is sustainability. Can Solana maintain uptime, decentralization, and institutional trust as volumes and use cases scale? Firedancer’s launch later this year, along with validator diversification efforts, will be critical to ensuring the network can handle the demands of full-scale financial integration.

But for now, the trend is clear: the institutional flywheel is picking up speed; ETFs bring in capital, staking offers yield, tokenization unlocks composability, and Solana appears to have the fastest-growing onramp to it all.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.