Sophia’s Thoughts On Friday’s Collapse

Markets collapsed on Friday as tariffs and algorithms triggered a historic crypto crash. Where does this leave the crypto markets?

These are Sophia's Thoughts:

A single tariff headline triggered a chain reaction of liquidations across asset classes.

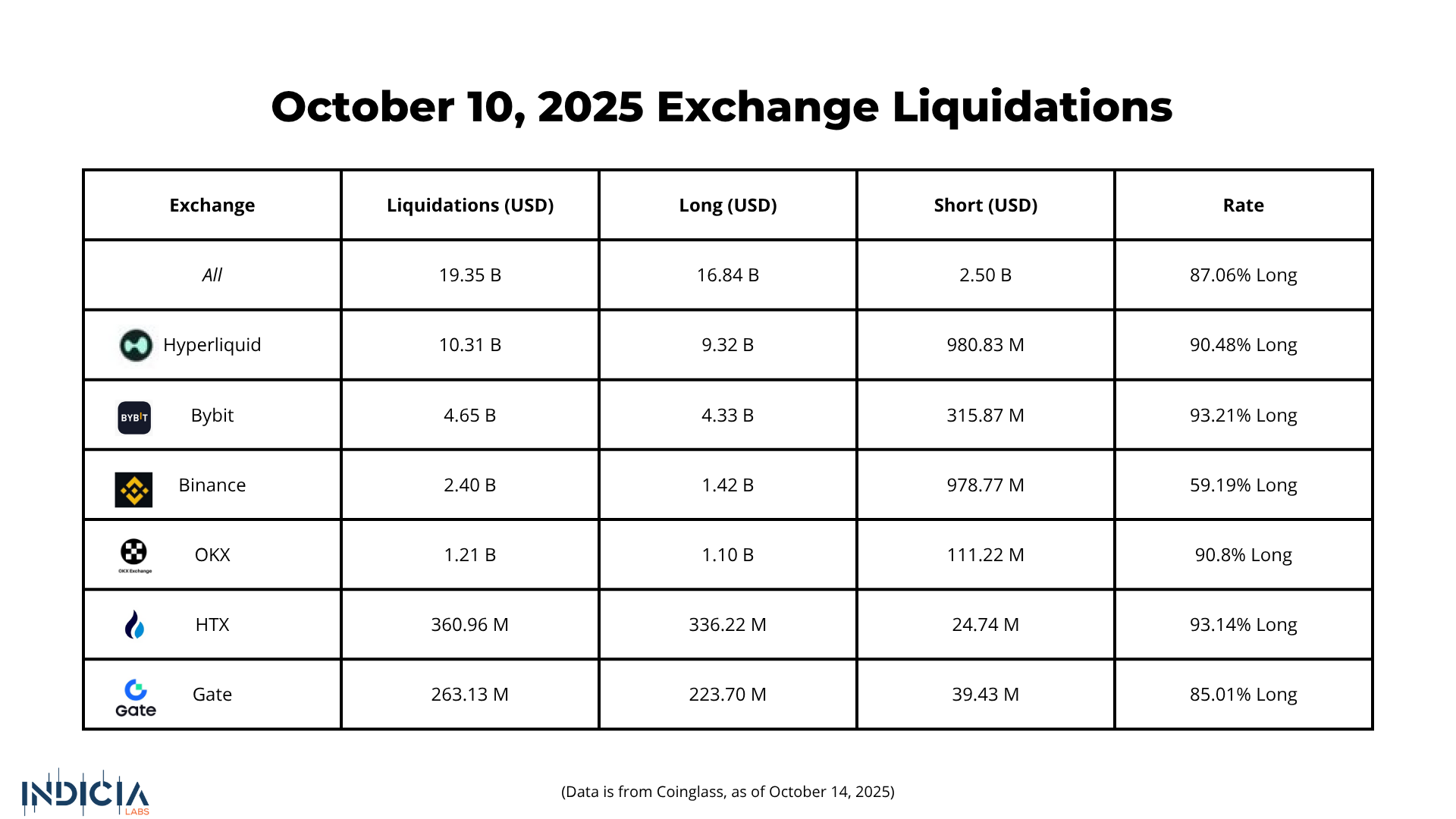

Over USD 19 billion in leveraged positions were liquidated in 24 hours — nine times larger than February’s crash.

The result: a violent reset that flushed excess leverage and may have cleared the path for cautious rebuilding.

🚀 Last week’s market performance

The crypto market fell 8.0% this week, marking the largest liquidation event in history. Bitcoin (BTC) dropped 7.4% as volatility surged across major exchanges. On the upside, Synthetix (SNX) soared 93.3% amid growing hype around its upcoming Dino coin launch. Kava (KAVA) was among the hardest hit, plunging 41.3% as selling pressure intensified across DeFi tokens.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

⚖️ Tariffs and the Trigger

It started with one announcement. On Friday, October 10, President Trump unveiled a 100% tariff on Chinese imports and threatened export controls on critical software, escalating an already tense standoff. The move rattled global risk assets.

Reuters reported that “the crypto sector on Friday saw more than $19 billion in liquidations across leveraged positions as panic selling and low liquidity triggered sharp swings.” Bitcoin plunged 14% from over USD 122,000 to just above USD 109,000 (depending on the exchange), while Ethereum dropped 12.2% to a low of USD 3,400. Altcoins like DOGE (-62%) and AVAX (-70%) were hit even harder.

By Monday, Bloomberg’s Sidhartha Shukla wrote that “the combined market value of all cryptocurrencies [fell] by more than $150 billion over a 24-hour period,” adding that “investors pulled $756 million from US Bitcoin and Ether exchange-traded funds on Monday, underscoring the sense of nervousness among traders.”

China responded with curbs on the American units of Hanwha Ocean Co., “hitting back against US measures against the Chinese shipping sector,” Bloomberg noted. The result was a synchronized global sell-off across U.S., European, and Asian markets.

Over the weekend, Trump softened his tone, saying the U.S. did not want to “hurt China” and that “it will all be fine.” Subsequently, Bitcoin rebounded above USD 110,000 and the rest of the market followed.

📉 Systematic Selling Meets Fragile Leverage

The crash wasn’t just about tariffs, it was also about timing and market structure. For months, algorithmic and volatility-targeting funds had been steadily adding exposure as markets trended higher and volatility stayed low. When tariffs hit and volatility spiked, those same systems flipped from buyers to sellers in hours. The result was a mechanical liquidation spiral: prices fell, models sold more, and leverage unwound in a self-reinforcing loop.

Reuters described the moment as a “rush to hedge against another potential freefall,” while Sean Dawson, head of research at Derive.xyz, noted: “Last Friday, you saw volatility just jump across the board … more people are worried about downward turns.”

But systemic leverage wasn’t the only culprit. A viral thread by analyst @ElonTrades argued that the crash was worsened by a flaw in Binance’s collateral pricing system, which valued certain assets (USDe, wBETH, and BNSOL) using internal order-book data instead of external oracles. When volatility hit, those assets depegged (USDe to $0.65 on Binance only, wBETH drops over 90%, BNSOL plunges to $0.13), instantly shrinking users’ collateral and triggering hundreds of millions in forced liquidations that rippled through the broader market.

Binance later confirmed that it “reimbursed $283 million to users affected by a recent wave of liquidations triggered by asset depegging,” noting that its core systems “stayed functional throughout” and attributing the episode to extreme market conditions. At the same time, analytics platform CoinGlass reported a “large-scale proxy strike” that briefly disrupted access to market data, another stress point during the panic.

Despite the chaos, Bitcoin held up better than expected. On-chain analyst Willy Woo observed that “bitcoin investor flows have been holding up well and may be the reason it fared better than expected against a sharp decline in stocks.” As Nic Puckrin, the co-founder of The Coin Bureau put it: “The good news is that this crash has cleaned out the excessive leverage and reset the risk in the market, for now.”

🔮 What It Means Going Forward

The crash was severe but not systemic. Analysts widely view it as capitulation, not collapse. Funding rates have normalized, open interest fell by roughly USD 10 billion, and the fastest wave of forced selling appears over. Glassnode reiterated that “the market now enters a consolidation phase, one defined by renewed caution, selective risk-taking, and a more measured rebuilding of confidence.”

Still, caution prevails. Traders remain hedged, volatility is elevated, and questions over market integrity persist. Moreover, a wallet dubbed the “Trump Insider Whale” opened massive short positions just before the tariff announcement, earning roughly USD 200 million. Researcher Janis Kluge of SWP Berlin warned: “Crypto investors are realizing what unregulated markets really mean — insider trading, corruption, and zero accountability.”

For disciplined investors, though, this reset may prove healthy. Puckrin believes that this liquidation event has reset the risk in the market, which would lead to the ecosystem being healthier in the long term.

Markets may still be volatile, but some argue that the flush was necessary. When humans panic and machines follow, systematic strategies amplify the fall, yet they also clear the excess. This may not have been a collapse of conviction, but a reset of risk. What follows will define whether the recovery is built on steadier ground.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.