Sophia’s Thoughts On October Rate Cuts

Markets are heading into the week laser-focused on the Federal Reserve, where a 25-basis-point rate cut appears certain, and investors are parsing what comes next.

These are Sophia's Thoughts:

Policymakers face a rare challenge: deciding on a rate cut amid a data blackout caused by the ongoing government shutdown.

Historical data shows crypto’s strongest rallies came early in the rate-cut cycle, with later moves producing muted or negative returns.

The focus shifts to Powell’s message and the CPI print on Friday, while the Fed’s Payments Innovation Conference underscores how conversations around stablecoins and blockchain are increasingly entering mainstream policy forums.

🚀 Last week’s market performance

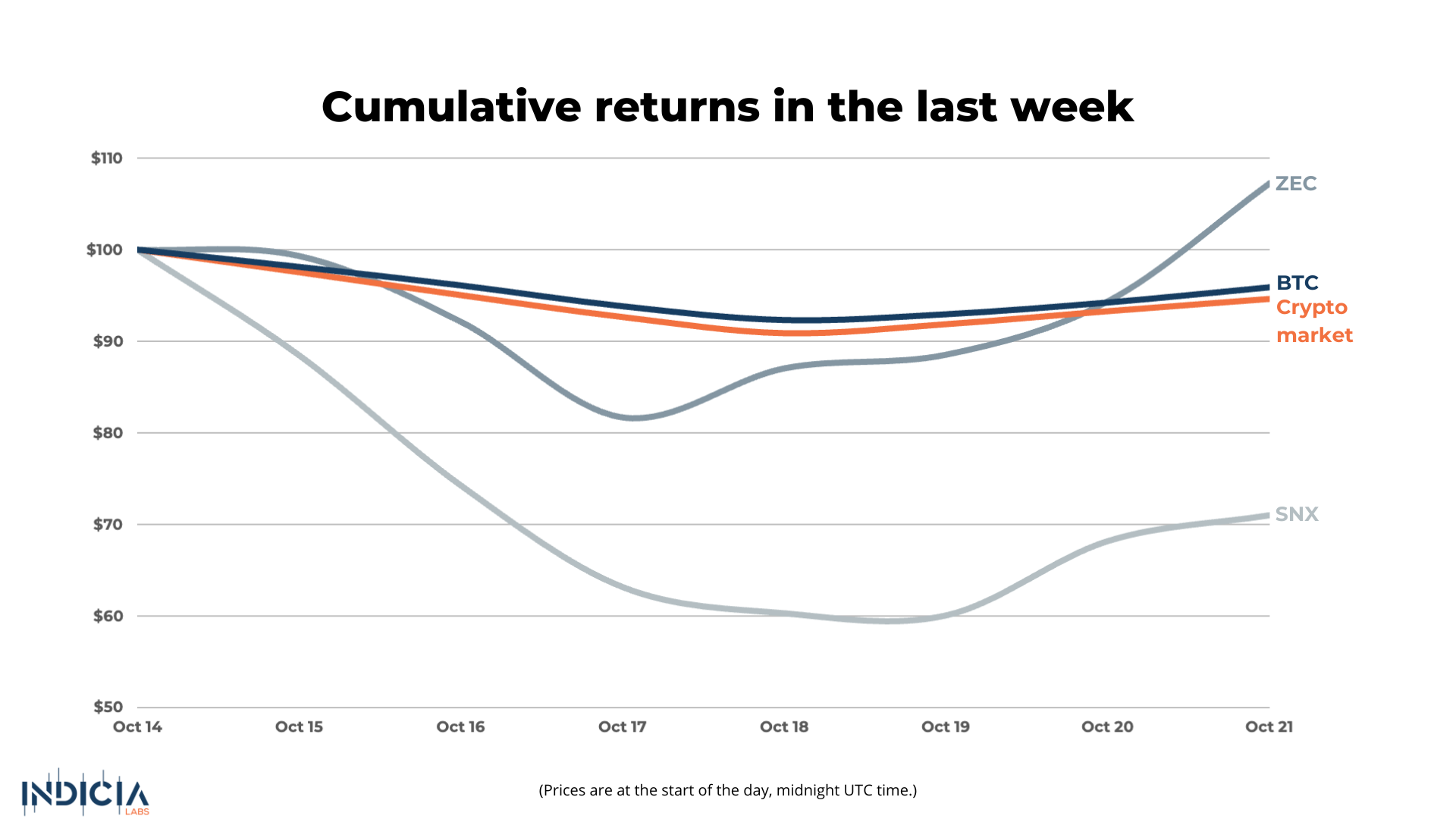

The crypto market declined 5.4% this week as risk sentiment remained weak following recent volatility. Bitcoin (BTC) fell 4.1%, extending its pullback from last week’s highs. Zcash (ZEC) was a rare outperformer, rising 7.3% on renewed network activity, while Synthetix (SNX) dropped 29% as momentum cooled after its triple-digit rally.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

📜 Policy Crossroads

Economists are nearly unanimous in expecting another rate cut on October 29th. According to a Reuters poll, 115 out of 117 economists forecast a 25-basis-point reduction next week, bringing the target range to 3.75%–4.00%, with another cut likely in December. The CME FedWatch Tool now shows a 96.7% probability of a rate cut at this month’s meeting.

The decision comes amid uncertainty. As Reuters reported, “a government shutdown that so far has lasted three weeks has delayed key official data on employment as well as inflation, blurring the economic outlook.” The next CPI report, scheduled for October 24, is expected to show that “consumer inflation rose to 3.1% last month from 2.9% in August,” according to the same poll.

Within the Fed, perspectives are diverging. Governor Christopher Waller supports another 0.25% cut due to signs of a weakening labor market, while Governor Stephen Miran has pushed for a faster pace of easing. Reuters noted that “President Donald Trump has been pressuring Powell to cut rates aggressively for months.” Brett Ryan, senior U.S. economist at Deutsche Bank, added, “The risk of the Fed losing its independence is elevated relative to any prior administration.”

📐Markets and Crypto’s Angle

Rate cuts have historically lifted crypto, but the impact has weakened over time. After the September 2024 and November 2024 reductions, Bitcoin and Ethereum posted double-digit rallies. Bitcoin gained more than 32%, and Ethereum climbed 47.5% over the following month. By contrast, the December 2024 and September 2025 cuts saw both assets fall, with Bitcoin down 7.4% and Ethereum losing 13.6% in the month after, suggesting the market had already priced in easier policy.

The Reuters survey found that “financial market traders are more convinced, and have fully priced in two more reductions this year to interest rate futures contracts.” Bitcoin is hovering near USD 111,000, while Ethereum is trading around USD 4,000, supported by expectations that lower yields will sustain risk appetite.

Still, some economists warn that easing amid a shutdown and patchy data could heighten volatility. As Ryan Wang, U.S. economist at HSBC outlined, “It would be fair to say approximately half of the current FOMC is more focused on the labor market and the other half on inflation risks.” That split, combined with limited visibility ahead of the CPI release, leaves both traditional and digital markets vulnerable to sharp swings if inflation surprises to the upside.

🔮 What It Means Going Forward

A 25-bps cut this month is nearly certain, but the real question is what Powell signals next. If he hints at another move in December, yields could drift lower into year-end, potentially spurring a late-quarter rally across risk assets.

Beyond rates, policy tone and innovation are converging. At the Fed’s Payments Innovation Conference starting October 21st, officials shared panels with Chainlink, Circle, Coinbase, and Stripe to discuss stablecoins, tokenized treasuries, and AI-driven payments. Fed Governor Christopher Waller, who also supports the upcoming cut, opened the conference by emphasizing “embrace the disruption” and the need to modernize financial rails.

This marks a notable development in tone. The Federal Reserve, which has historically treated crypto with caution, is now holding open discussions about its role in financial infrastructure. In the short term, market conditions will depend on upcoming inflation data and the Fed’s policy communication. Over the longer horizon, ongoing dialogue between policymakers and industry participants suggests that digital assets are increasingly part of the conversation around financial innovation and regulation.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.