Sophia’s Thoughts On Strategy’s Bitcoin-Selling Scare

Strategy’s sharp stock plunge, renewed forced-sale fears, and Michael Saylor’s largest Bitcoin purchase in months collided this week to test market conviction and reshape the narrative around levered corporate Bitcoin holdings.

These are Sophia's Thoughts:

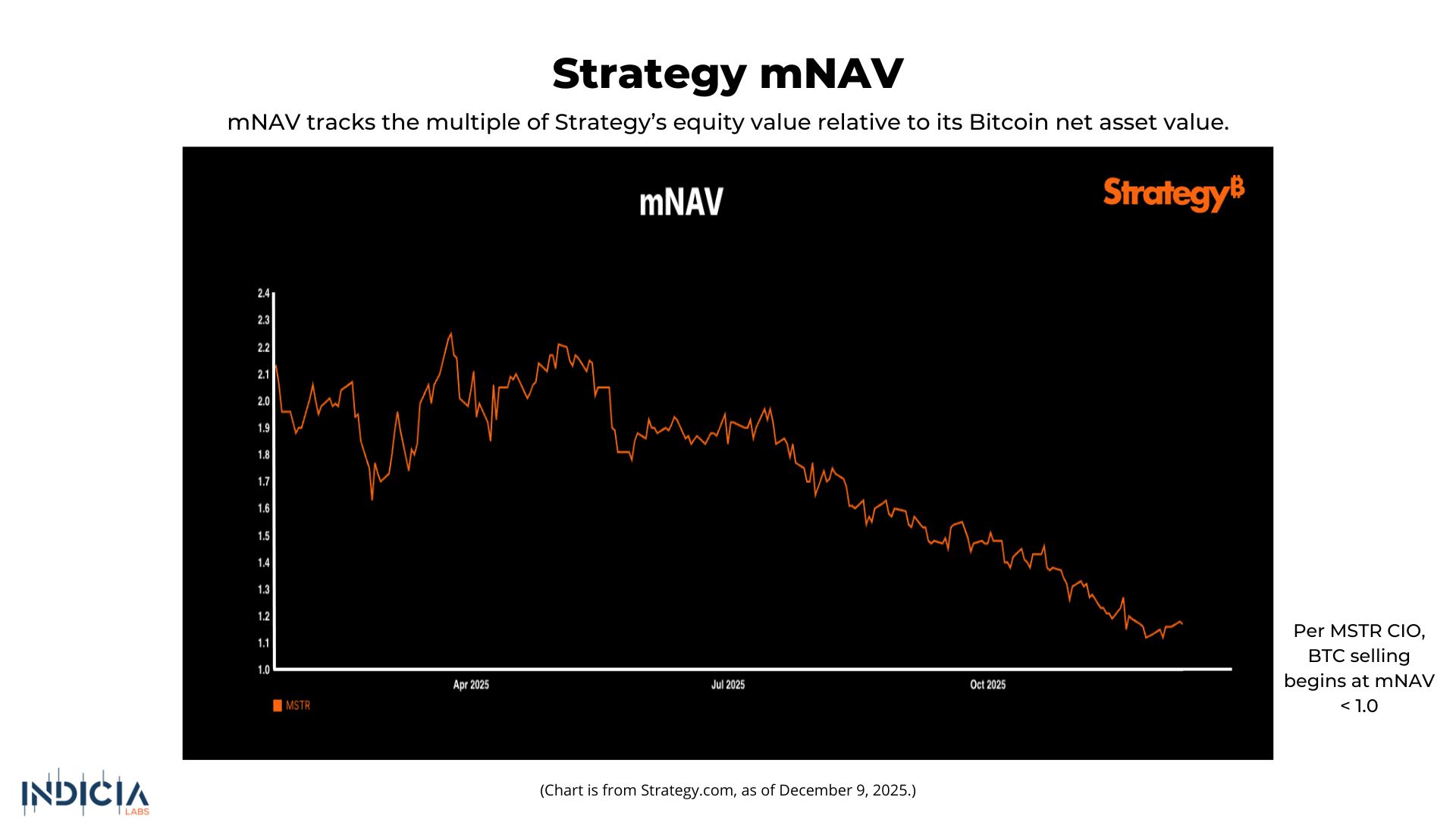

Strategy came out stating that they may have to liquidate their Bitcoin holdings if the mNAV drops below 1.0, before a USD 1.4 bn cash reserve was amassed, stabilizing the stock price.

Beneath the volatility lies a highly leveraged Bitcoin engine whose rising dividend burdens and constant need for new capital are increasingly shaping Strategy’s behavior.

Despite the headlines, analysts agree that Strategy’s liquidity buffer, deeper institutional markets, and higher buyer absorption make a forced-sale cascade far less likely than the fear suggests.

🚀 Last week’s market performance

The crypto market gained 6.0% this week as risk appetite improved across digital assets. Bitcoin (BTC) rose 5.1%, extending its rebound after recent weakness. Terra Classic (LUNC) was the standout performer, surging 106% after Ian Allison wore a LUNC shirt at the Binance conference. Meanwhile, Quant (QNT) was the week’s weakest mover, falling 12.2%.

🧐 What is your crypto mood today?

In each Sophia's Thoughts newsletter, we ask about your crypto mood. Your response to this question helps Sophia get a better sense of the pulse of crypto markets. And this ultimately translates into better insights for you when combined with Sophia's AI models. Your data empowers Sophia to provide you with even better intelligence going forward!

📉 A Steep Drawdown Sparks Forced-Sale Fears

Bitcoin’s drop from October highs triggered one of the sharpest drawdowns in Strategy’s stock since 2020. Shares are now down 61% from their peak, and the market is actively questioning whether the world’s largest corporate Bitcoin holder might eventually be forced to sell.

The sell-off began as analysts sounded alarms about Strategy’s leverage and massive obligations. The Motley Fool highlighted that investors worry the company “could eventually be forced to dump its Bitcoin to repay debt, and whether that could crush the coin itself if it happens.” At the same time, market structure around Strategy deteriorated: according to MarketWatch, the stock has been “trading below the value of the bitcoin it holds since November,” reversing the premium it enjoyed for years.

Yet the company responded by accelerating purchases. In the last week alone, Strategy bought 10,624 BTC for USD 962.7 million, its largest acquisition since July. Michael Saylor teased the purchase on X with the caption “₿ack to Orange Dots?”

Despite the fear, several analysts emphasized that the company remains solvent at current prices. Bitwise CIO Matt Hougan argued the new cash reserve means Strategy is “nowhere close to needing to liquidate its bitcoin to meet obligations right now.”

🪙 A High-Leverage Bitcoin Engine Under Pressure

At its core, Strategy is a leveraged Bitcoin vehicle. When Bitcoin falls, Strategy’s equity absorbs the first-loss risk, and this selloff exposes structural stress that had been building. Strategy holds 660,624 BTC, over 3% of all Bitcoin, accumulated using equity and debt. As The Motley Fool noted, the company spent “about $48.4 billion building that position, at an average cost of roughly $74,400 per coin.”

The problem: Strategy’s balance sheet has grown increasingly complex and expensive. Frontier Investments CEO Louis LaValle explained the company’s deeper constraint bluntly: “He almost has to keep buying at this point.” He added: “He needs to [raise money to buy bitcoin] to keep the engine running.”

LaValle went further: “Strategy does not generate enough sustainable cash flow to repay the dividends each year, and therefore must rely on selling stock to meet those obligations.” Across its preferred share classes, Strategy now faces roughly USD 800 million in annualized dividend obligations.

To stabilize the situation, Strategy created a USD 1.44 billion USD reserve. Phong Le clarified this covers “around 21 months of dividend and interest payments,” and emphasized that Strategy would only consider selling BTC if two conditions were met: the stock trades below NAV and the company loses access to both debt and equity markets. As JPMorgan put it, “Strategy’s resilience was key to bitcoin’s price direction in the near term.”

✨ Less Systemic Risk Than Headlines Suggest

The crypto market spent the week debating whether forced selling from Strategy could trigger a broader Bitcoin cascade. But the data and analyst commentary suggest the systemic risk is far lower than sentiment implied.

The Motley Fool noted that insolvency-level pressure doesn’t emerge until “a Bitcoin price of about $25,000,” meaning there is “still a very long way left to fall before it’s time to start sweating.” Phong Le reinforced that the company is not close to being a seller after establishing its liquidity reserve, which was explicitly intended to “eliminate concerns that dividend obligations could trigger forced selling of Bitcoin.”

Meanwhile, Bitcoin’s market is far deeper than it was in 2020. As The Motley Fool pointed out: “Bitcoin’s market is far deeper and more institutional than when Strategy started buying.” ETFs, sovereign treasuries, and a growing corporate cohort now absorb far more volume, reducing the likelihood that even a large seller could destabilize the asset.

Still, the episode marks a turning point in how investors view Bitcoin treasury companies (DATs). CoinShares’ James Butterfill wrote that “the market is re-evaluating which companies genuinely fit the DAT model and which were simply riding momentum.” And yet, not everyone is pessimistic. Benchmark analyst Mark Palmer said “the fact that Strategy was able to sell both common equity and preferred means that there's a market for its securities.” Anthony Scaramucci summarized the strategic advantage simply: Saylor’s approach is smart both for his company’s balance sheet and the overall Bitcoin market.

Bottom line: The scare revealed the fragility of highly leveraged Bitcoin accumulation models, but it did not threaten Bitcoin itself. With deeper institutional liquidity, a robust reserve at Strategy, and ongoing corporate adoption, the structural case remains intact. The real narrative shift is not about forced selling, but about which corporate Bitcoin strategies can sustain themselves in a more mature market environment.

Indicia Labs does not provide investment, tax, or legal advice. You are solely responsible for determining the suitability of any investment, investment strategy, or related transaction based on your personal investment objectives, financial circumstances, and risk tolerance. Indicia Labs may offer educational information about digital assets, which may include blog posts, articles, third-party content, news feeds, tutorials, and videos. This information does not constitute any form of advice, and you should not rely on it as such. Indicia Labs does not recommend buying, earning, selling, or holding any digital asset and will not be responsible for any decisions you make based on the provided information. Any content provided by Indicia Labs may contain errors, inaccuracies, or outdated information and should not be relied upon for making any investment decisions and Indicia Labs and its affiliates hold no responsibility for the accuracy of the provided information or content.

As with any asset, the value of digital assets can fluctuate, and there is a significant risk of losing money when buying, selling, holding, or investing in digital assets. Consult your financial advisor, legal or tax professional regarding your specific situation and financial condition, and carefully consider whether trading or holding digital assets is suitable for you.

Indicia Labs is not registered with the U.S. Securities and Exchange Commission and does not offer securities services in the United States or to U.S. persons. You acknowledge that digital assets are not subject to protections or insurance provided by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.